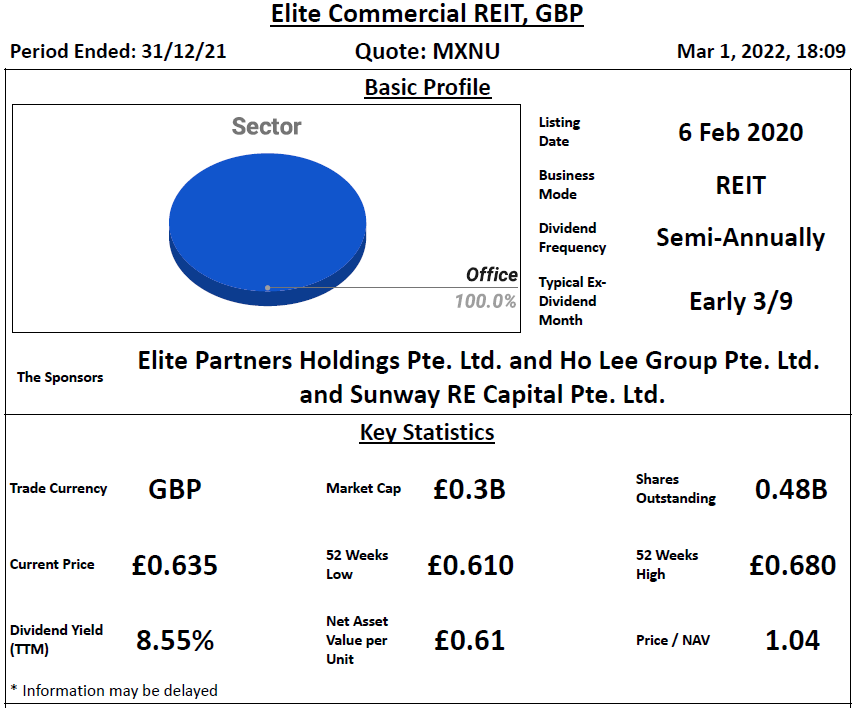

Basic Profile & Key Statistics

Performance Highlight

The East Street, Epsom has secured a new lease with 11% rental increase while Sidlaw House, Dundee tenant has exercised the lease break option.

Related Parties Shareholding

- REIT sponsor's shareholding is low at 6.329%

- REIT manager's shareholding is high at 1.579%

- Directors of REIT manager's shareholding is high at 11.605%

Lease Profile

- Occupancy is high at 100%

- WALE is long at 6 years

- Highest lease expiry within 5 years is low at 3.8% which falls in 2022

- Almost all properties are freehold or longer than 99 years remaining land tenure

Debt Profile

- Gearing ratio is high at 42.4%

- Cost of debt is low at 2%

- Fixed rate debt % is low at 63%

- All debts are secured debts

- WADM is short at 2.1 years

- Highest debt maturity within 5 years is high at 55.4% which falls in 2024

- Interest coverage ratio is high at 6 times

Diversification Profile

- Top geographical contribution is low at 13.3%

- Top property contribution is low at 9.3%

- Top 5 properties contribution is low at 26.2%

- Top tenant contribution is high at 91%

- Top 10 tenants contribution is high at 100%

Key Financial Metrics

- Property yield is high at 6.7%

- Management fees over distribution is low at 10% in which unitholders receive £ 10 for every dollar paid

- Distribution on capital is high at 4.7%

- Distribution margin is high at 70.6%

Trends

- Uptrend - DPU

- Flat - NAV per Unit, Distribution Margin

- Downtrend - Interest Coverage Ratio, Property Yield, Distribution on Capital

Relative Valuation

- P/NAV - Below -1SD for 1y; Below average for 3y

- Dividend Yield - Above +2SD for 1y and 3y

Author's Opinion

| Favorable | Less Favorable |

|---|---|

| High REIT Manager's Shareholding | Low REIT Sponsor's Shareholding |

| High Directors of REIT Manager's Shareholding | Concentrated Lease Break Period |

| High Occupancy | High Gearing Ratio |

| Long WALE | Low Fixed Rate Debt % |

| No Major Lease Expiry within 5 Years | 0% Unsecured Debt |

| Almost 100% Freehold Properties | Short WADM |

| Low Cost of Debt | Concentrated Debt Maturity |

| High Interest Coverage Ratio | High Top Tenant & Top 10 Tenants Contributions |

| Low Top Geographical Contribution | Interest Coverage Ratio Downtrend |

| Low Top Property & Top 10 Properties Contributions | Property Yield Downtrend |

| High Property Yield | Distribution on Capital Downtrend |

| Competitive Management Fees | |

| High Distribution on Capital | |

| High Distribution Margin | |

| DPU Uptrend |

With the full half-yearly contribution from newly acquired properties, Elite performance has been improved. For the high lease break % of 63.3% is in 2023 (mainly March 2023), 100 of the 117 DWP-occupied assets has confirmed removal of this lease break option, so the leases will continue straight to March 2028.

You could also refer below for more information:

SREITs Dashboard - Detailed information on individual Singapore REIT

SREITs Data - Overview and Detail of Singapore REIT

REIT Analysis - List of previous REIT analysis posts

REIT-TIREMENT Telegram Channel - Join to receive updates on new post

REIT-TIREMENT Patreon - Support my work and get exclusive contents

REIT-TIREMENT Facebook Page - Support by liking my Facebook Page

REIT Investing Community - Facebook Group where members share and discuss REIT topic

*Disclaimer: Materials in this blog are based on my research and opinion which I don't guarantee accuracy, completeness, and reliability. It should not be taken as financial advice or a statement of fact. I shall not be held liable for errors, omissions and loss or damage as a result of the use of the material in this blog. Under no circumstances does the information presented on this blog represent a buy, sell, or hold recommendation on any security, please always do your own due diligence before any decision is made.

already know tenant decision isnt it for 100 out of eh 117?

ReplyDeleteonly 17 left or ard 20% of lease that is still awaiting tenant decision up to Mar22.

Hi Rokawa,

DeleteMy bad, miss out the notice on 28 Feb during the review. Thanks for informing. already updated the post.