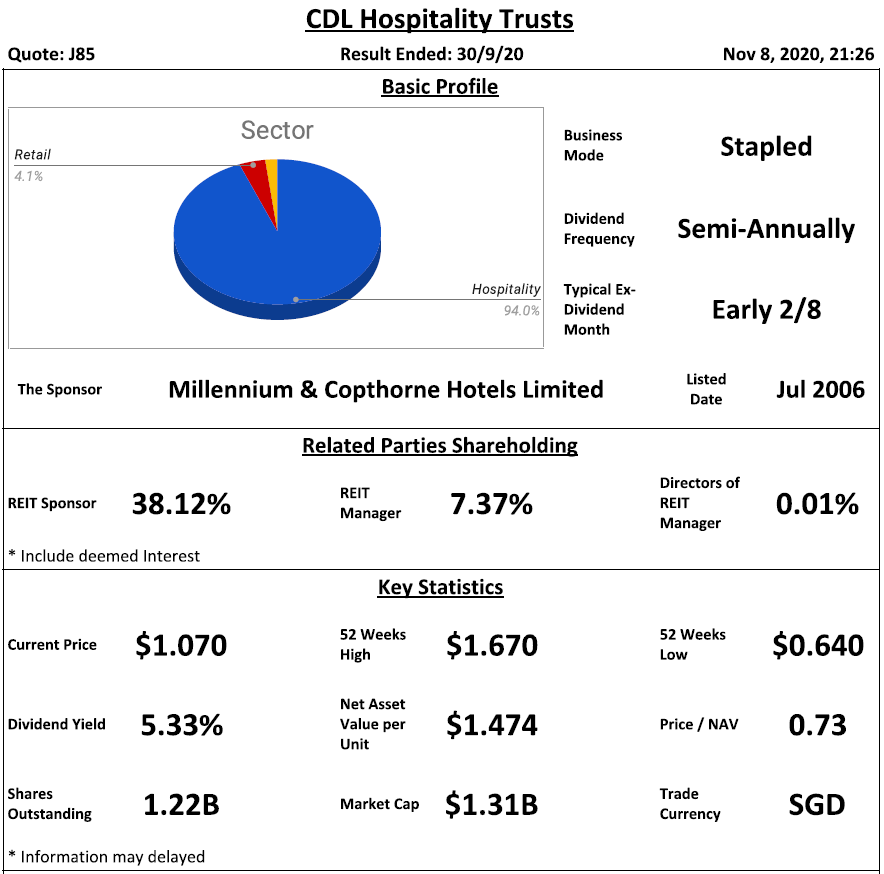

Basic Profile & Key Statistics

Quarter Performance Review

Debt Profile

Gearing ratio is healthy at 36.7%. Cost of debt is low at 1.8% with 90.2% unsecured debt (based on previous quarter). Fixed rate debt % is low at 61.5%. Interest cover ratio is low at 2.9 times. WADE is short t 2.5 years where the highest debt maturity of 31.3% falls in 2021.

Diversification Profile

Property yield and distribution on capital are low at 2.9% for both. Management fee is not competitive in which unitholders receive S$ 5.88 for every dollar paid to the manager. Distribution margin is slightly low at 44.6%. 9% of the past 4 quarters DPU is from distribution from asset disposal. In 1H 2020, CDLHT did not provide any distribution from asset disposal.

Trends

CDLHT did a rights issue in 3Q 2017, so let's only compare the period after this.

Flat - NAV per Unit

Downtrend - DPU, Interest Cover Ratio, Property Yield, Distribution Margin

Relative Valuation

i) Average Dividend Yield - Average yield at 6.37%, apply the annualized past 4 quarters DPU of 5.70 cents will get S$ 0.895.

ii) Average Price/NAV - Average value at 0.96, apply the latest NAV of S$ 1.474 will get S$ 1.415.

Author's Opinion

| Favorable | Less Favorable |

|---|---|

| Long WALE | Low Interest Cover Ratio |

| Well Spread Lease Expiry | Short WADE |

| Low Cost of Debt | High Top Tenant & Top 10 Tenants Contributions |

| High Unsecured Debt | Low Property Yield |

| Low Top Geographical Contribution | Low Distribution on Capital |

| Low Top Property Contribution | DPU Downtrend |

| Interest Cover Ratio Downtrend | |

| Property Yield Downtrend | |

| Distribution Margin Downtrend |

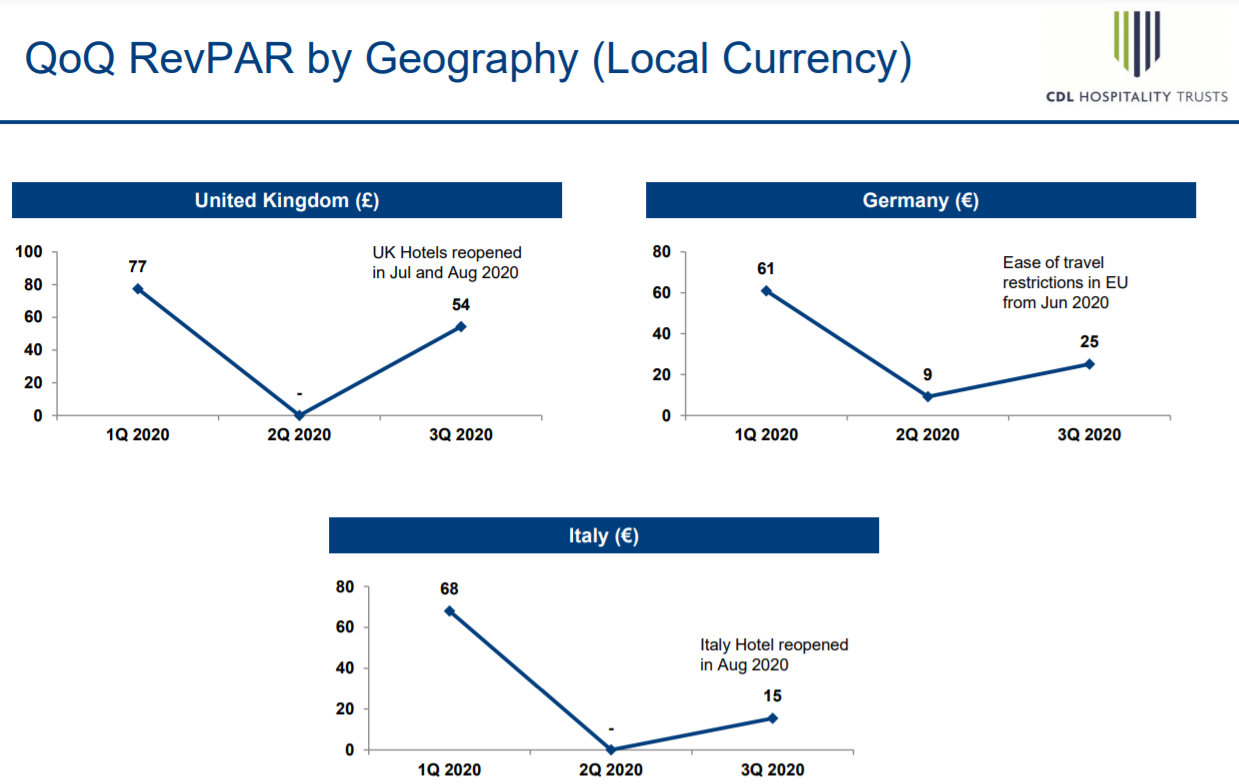

In July, CDLHT had divested Novotel Singapore Clarke Quay and acquired W Singapore - Sentosa Cove. Subsequently, CDLHT has also divested Novotel Brisbane on 30 October. AEI for Raffles Maldives Meradhoo is expected to be completed by November, albeit tourism demand is still very low for the Maldives. On a QoQ basis, CDLHT performance has seen improvement. However, with some countries impose new lockdowns, it would be a very challenging task for CDLHT to further improve its performance, especially for its England, Germany and Italy properties.

For more information, you could refer to:

SREITs Dashboard - Detailed information on individual Singapore REIT

SREITs Data - Overview of Singapore REIT

REIT Analysis - List of previous REIT analysis posts

REIT-TIREMENT Patreon - Support this blog as a Patron and get SREITs Dashboard PDF

REIT Investing Community - Facebook Group where members share and discuss REIT topic

*Disclaimer: Materials in this blog are based on my research and opinion which I don't guarantee accuracy, completeness, and reliability. It should not be taken as financial advice or a statement of fact. I shall not be held liable for errors, omissions as well as loss, or damage as a result of the use of the material in this blog. Under no circumstances does the information presented on this blog represent a buy, sell, or hold recommendation on any security, please always do your own due diligence before any decision is made.

No comments:

Post a Comment