The first half of 2025 has been a challenging one for Singapore REITs. At the start of the year, CME FedWatch projections suggested a possible rate cut by March. However, the U.S. Federal Reserve held firm, keeping interest rates unchanged to date. In April, the announcement of US reciprocal tariffs triggered a pullback in S-REIT prices. While a 90-day extension was later granted, the looming 9 July deadline continues to weigh on sentiment.

As of 30 June, the iEdge S-REIT Index is still hovering around its starting point for the year. Now, let’s take a closer look at how individual S-REITs have performed over the past six months in terms of total return.

Overall Returns

The graph below shows the total returns for each counter, including Business Trust CapitaLand India Trust. Dividend yields are calculated based on ex-dividend dates.

Total returns, inclusive of dividends, have been largely positive. More than half of the S-REITs delivered positive total returns in 1H 2025. Notably, 6 counters posted gains above 10%. Here’s a breakdown of the numbers:

- Average Dividend: 3.05%

- Average Capital Gain: 0.27%

- Average Total Return: 3.32%

- Median Dividend: 3.27%

- Median Capital Loss: -0.93%

- Median Total Return: 1.53%

Next, let’s zoom in on the “MCFK” group – Mapletree, CapitaLand, Frasers, and Keppel – four of the largest REIT sponsors in Singapore:

- Average Dividend: 2.92%

- Average Capital Gain: 3.19%

- Average Total Return: 6.11%

- Median Dividend: 3.09%

- Median Capital Loss: 2.93%

- Median Total Return: 6.56%

MCFK REITs outperformed the broader S-REIT universe in both average and median total returns.

Ranking

Top 10 Highest Returns

- 4 are MCFK REITs

- 3 are Industrial REITs

- 3 with Office-focused portfolios

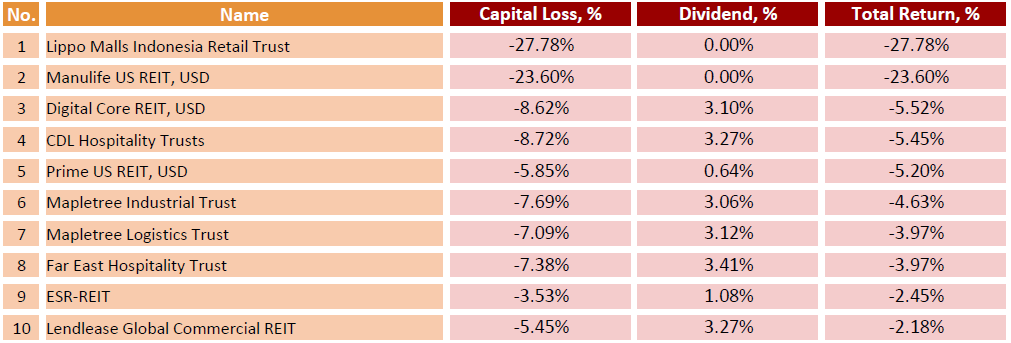

Top 10 Lowest Returns

- 4 with no assets in Singapore

- 3 with U.S.-only assets

- 3 are industrial REITs

Statistics for Returns

- 6 posted 10%+ total returns

- EC World REIT remained at 0% due to suspension

- 2 recorded losses of 20% or more

Wrap-Up

Dividends were the main driver of total returns in 1H 2025, with capital gains remaining limited amid macro uncertainty. Looking ahead, NTT DC REIT – a data centre REIT backed by Japanese telecom giant NTT – has filed a preliminary prospectus in late June. The IPO may list a portfolio of six data centres across the U.S., Austria, and Singapore. You can download the IPO prospectus here.

Meanwhile, CME FedWatch projects a likelihood of a 50bps rate cut by the end of 2025, with the first move possibly coming in September. This anticipated easing could lend support to yield-sensitive sectors like REITs in the second half of 2025.

For more information, check out:

S-REITs Dashboard - Detailed information on individual Singapore REIT

S-REITs Data - Overview and detail of Singapore REITs

S-REIT Comparison - Comparison among Singapore REITs

REIT Review - List of previous REIT review posts

Patreon - Subscribe and get exclusive content

Investing Note - Support by following my Investing Note profile

Facebook Page - Support by liking my Facebook Page

Facebook Group - Passive Income Investing Community - Join to share and discuss REITs

Telegram Channel - Singapore REITs Post - Join to receive posts for Singapore REITs

Buy Me a Coffee - Treat me a coffee for my efforts

*Disclaimer: The information presented on this blog is for educational and informational purposes only. The materials, including research and opinions, are based solely on my findings and should not be considered professional financial advice or a definitive statement of fact. I cannot guarantee the accuracy, completeness, or reliability of the information provided. I shall not be held liable for any errors, omissions, or losses that may occur as a result of using the information presented on this blog. It should be noted that the information presented on this blog does not constitute a buy, sell, or hold recommendation for any security. It is crucial to conduct your own thorough research and due diligence before making any investment decisions.

Great sharing Vince 👍

ReplyDeleteThanks for your kind words

DeleteGood format to show total returns. Is there any chance you could show a summary of their past total returns for past say 5 years, just to give a sense of trending? Do you only do this half yearly or quarterly?

ReplyDeleteThanks for your kind words! I publish total return updates every half year. While I don't track 5-year total returns specifically, you can check out the 5-year price performance on the S-REITs Data page.

Delete