Basic Profile & Key Statistics

Performance Review

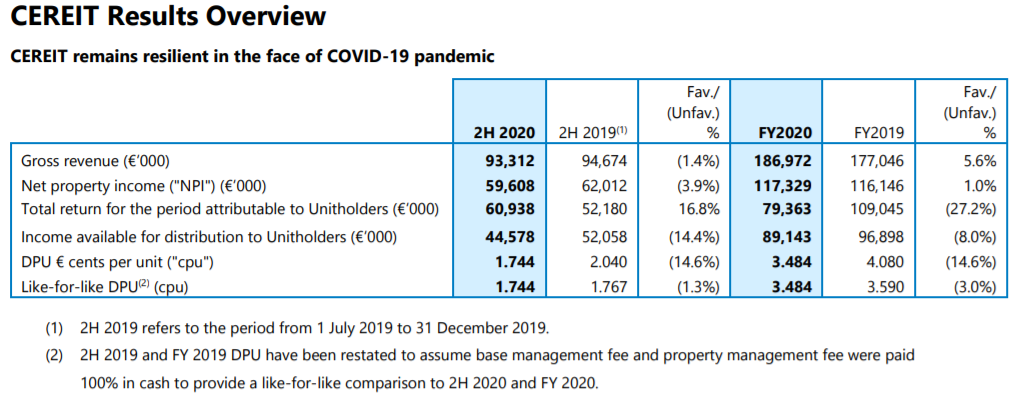

Gross revenue and NPI decreased YoY by 1.4% and 3.9% respectively. Distributable income and DPU decreased YoY by 14.4% and 14.6% respectively due to both management base management fee and property management fee received in cash for 2H 2020.1 day after the financial result is released, CEREIT announced the launch of the private placement (at € 0.43 to raise €100 million) to partially replenish working capital for recently acquired logistics park located in Italy and to partially fund the acquisition of properties in the Czech Republic and Slovakia which is targeted to complete by March 2021.

Lease Profile

- Occupancy is slightly high at 95.1%

- WALE is long at 4.9 years

- Highest lease expiry within 5 years is high at 58.6% which falls in 2025 and beyond, without breakdown.

- Weighted average land lease expiry is long at 93.6 years

Debt Profile

- Gearing ratio is moderate at 38.1%

- Cost of debt is low at 1.7%

- Fixed rate debt % is high at 100%

- Unsecured debt % is high at 91%

- WADE is long at 3.8 years

- Highest debt maturity within 5 years is high at 36.2% which falls in 2022

- Interest coverage ratio is high at 6.4 times

Diversification Profile

- Top geographical contribution is low at 9.1% (from 2019 Annual Report)

- Top property contribution is low at 8.4% (from 2019 Annual Report)

- Top tenant contribution is high at 13.2%

- Top 10 tenants contribution is low at 33.8%

- Top 3 countries contributed around 68% of GRI

Key Financial Metrics

- Property yield is slightly high at 5.6%

- Management fees over distribution is competitive at 5.9% in which unitholders receive €16.95 for every dollar paid

- Distribution on capital is high at 4.1%

- Distribution margin is slightly low at 46.2%

- 3.2% of the past 4 quarters' distribution is from asset disposal.

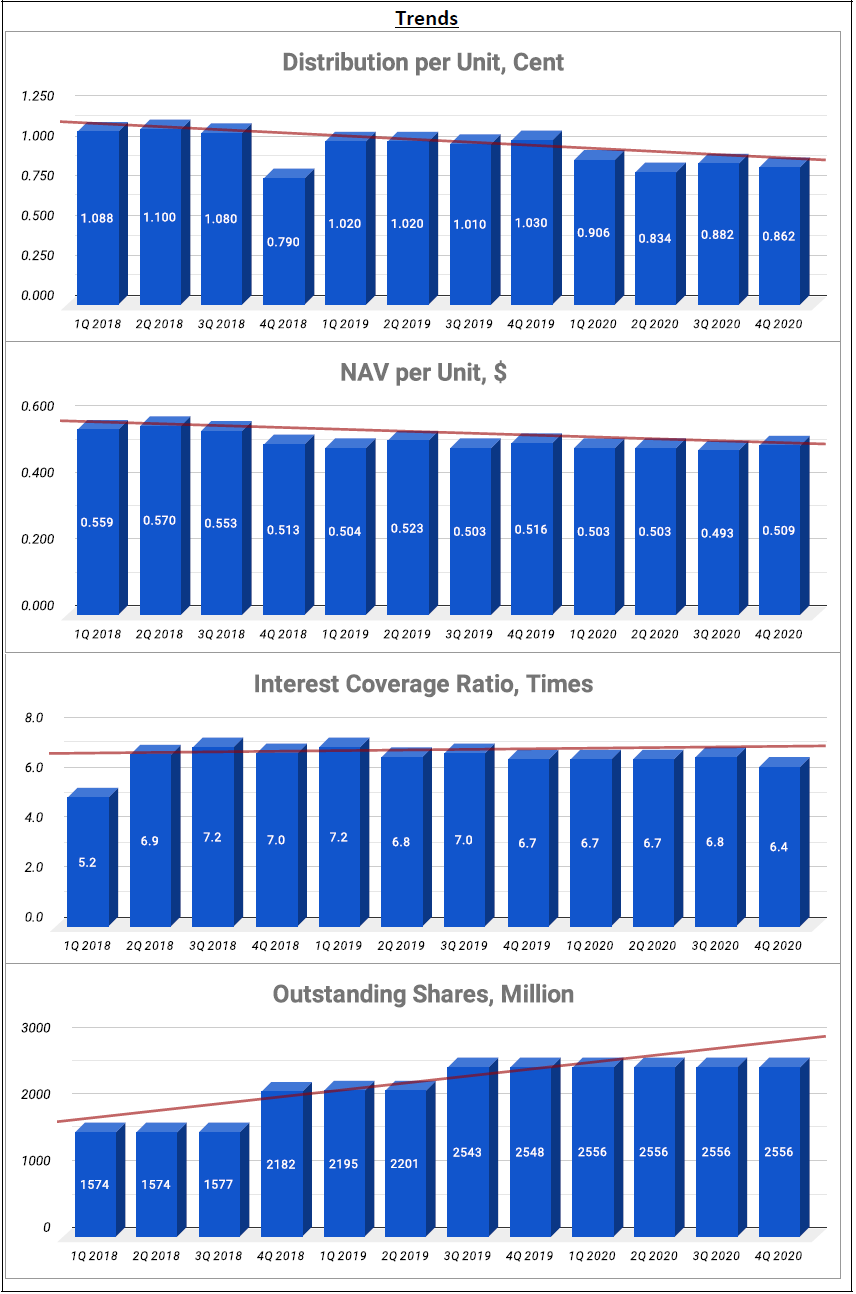

Trends

- Slight Uptrend - Interest Coverage Ratio

- Downtrend - DPU, NAV per Unit, Property Yield, Distribution on Capital, Distribution Margin

Relative Valuation

- Dividend Yield - Past 4 quarters DPU @ 3.484 cents / average yield @ 8.14% = € 0.43

- Price/NAV - NAV @ €$ 0.509 x average P/NAV @ 0.95 = € 0.485

Author's Opinion

| Favorable | Less Favorable |

|---|---|

| Diversified Sector | Concentrated Debt Maturity |

| Long WALE | High Top Tenant Contribution |

| Long Weighted Average Land Lease Expiry | DPU Downtrend |

| Low Cost of Debt | NAV per Unit Downtrend |

| High Unsecured Debt | Property Yield Downtrend |

| Long WADE | Distribution on Capital Downtrend |

| High Interest Coverage Ratio | Distribution Margin Downtrend |

| Low Top Geographical Contribution | |

| Low Top Property Contribution | |

| Low Top 10 Tenants Contribution | |

| Competitive Management Fee | |

| High Distribution on Capital |

The main reason for DPU decrease is due to both base management fees and property management fees had been paid 100% in cash for FY 2020. Overall, CEREIT fundamentals remain healthy at this moment. As for the private placement, it is at 0.21% DPU accretive (pro forma) based on the issued price of € 0.44. And since the final issued price is fixed lower at € 0.43, the DPU accretion (or dilution) would be insignificant.

For more information, you could refer to:

SREITs Dashboard - Detailed information on individual Singapore REIT

SREITs Data - Overview of Singapore REIT

REIT Analysis - List of previous REIT analysis posts

REIT-TIREMENT Patreon - Support this blog as a Patron and get SREITs Dashboard PDF

REIT Investing Community - Facebook Group where members share and discuss REIT topic

*Disclaimer: Materials in this blog are based on my research and opinion which I don't guarantee accuracy, completeness, and reliability. It should not be taken as financial advice or a statement of fact. I shall not be held liable for errors, omissions as well as loss or damage as a result of the use of the material in this blog. Under no circumstances does the information presented on this blog represent a buy, sell, or hold recommendation on any security, please always do your own due diligence before any decision is made.

No comments:

Post a Comment